By Nick Gertsema, CFP®, ChFC®, RICP®, AIF®, VP & Wealth Advisor

Too often in the world of personal finance, we find ourselves focusing on what you can’t or shouldn’t do.

Every year, there’s a new campaign out there that makes promises that feel unreasonable. “Stop drinking your favorite lattes and invest that money and you’ll retire early!” Save everything, spend nothing, and you can retire at 35!”

The overarching theme is to make drastic cuts in your standard of living now so that you can enjoy life later.

Unfortunately, we are not promised tomorrow.

The old adage says money can’t buy happiness, but what does that mean? I’m sure you can be just as miserable in traffic in a Ferrari as you are in a Taurus but is luxury really happiness?

In my experience, people I know tend to be happier when they spend their money on experiences or on something that enriches their lives. As recording artist Prince once said, “Money won’t buy happiness, but it’ll pay for the search.”

So, how can you find happiness?

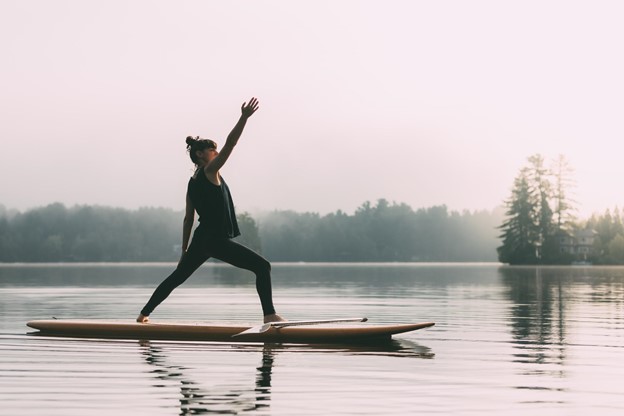

Alleviate Stress and Promote Health

There are hundreds of old sayings I could put here, but I think we all know that our health can slow down and that we will not live forever. Ask any doctor about whether stress and lack of exercise are good for you and I’m willing to bet that their answers will be the same.

It is important for your wellbeing that you find ways to alleviate stress in your life.

That may mean:

- Forcing yourself away from work and taking a vacation

- Treat yourself to doing something that you enjoy

- Enjoying your favorite latte

- Or, even looking at the amount of stress created by your job and deciding whether it is truly worth it.

The amount of stress our careers can have on us can sometimes be overlooked.

People can fall into the trap of thinking they have to keep working long hours and for many more years because that’s a reality that they’ve accepted.

It’s not uncommon to put together a comprehensive financial plan and have a client realize that the light at the end of the tunnel is closer than they thought. They may be able to reduce hours, retire early, or quit their current job and supplement their income with a job they enjoy.

We won’t live forever, but exercise can increase our chances of living longer and healthier lives. Just buying a membership to a gym will not necessarily get the job done. Unfortunately, gym memberships don’t work unless you actually use the gym.

If you want to invest in your health, invest in an activity or club that you think you will enjoy and that you know you can stick to.

It’s the Little Things

Allowing yourself to indulge every now and again is not always a bad thing.

If one of the highlights of your morning is a $5 cup of coffee from your favorite coffee shop and it fits in your budget, then go for it. Don’t completely deprive yourself of things you enjoy just because they cost money.

Sometimes, small purchases can have as much or more of an impact on your happiness as large purchases. Think about the value section as you walk into your favorite department store.

The most important thing about these small purchases is to make sure that they fit within your budget.

Don’t go running to spend your paycheck the second it hits your account. Do make a budget and allow some space for discretionary purchases. Budgets are worthless if you are not honest about what you are likely to do.

If you know you like your morning latte, make room for it in your budget.

Buy Yourself Some Time

On a family vacation a few years ago, I remember walking into a gas station and immediately being hit with the overwhelming smell of stale pizza.

As I waited for one of my children to finish what we had come inside for them to do, I saw a poster on the wall. It depicted a mother and her son. He was wearing a baseball uniform that was covered in dirt. The message across the poster said something to the effect of, “Spend your time on something that matters.”

The overwhelming message was if I bought pizza, I wouldn’t have to cook or have a huge mess to clean, I could spend that time with family.

Guess what we had for dinner that night? Pizza.

I’m not saying you should stop cooking and only eat pizza. At that moment, I knew that we were on a family vacation to create memories, and that stressing over dinner was not in our best interest.

Are there things in your life that you don’t necessarily have to do yourself that pull you away from what matters?

Maybe it’s:

- Hiring someone to help clean your house once a week

- Using an electric pressure cooker that saves you cooking and cleaning time

- Hiring the neighbor kid to mow your lawn, so you don’t have to spend the time or energy doing it

These purchases could make sense and potentially make your life a little happier if you choose to invest the time you saved into something that matters.

As Douglas A. Boneparth tweeted, “You can spend all your money and enjoy life now. You can save all your money and enjoy life later. Or, you can balance spending and saving and just enjoy life.”

Don’t Forget Your Future!

Spending money can become a problem if you have not created a plan for it. Do not mortgage your future for a few lattes today. Make a plan and stick to it. We are not promised tomorrow, but we do have to plan for it.

One of the most important things in budgeting and planning is finding financial balance.

If you would like to put together a comprehensive plan to help you find financial balance, get in touch today, and let’s start the conversation.