By Scott Keegan, CFP®, Chief Operating Officer/Wealth Advisor

It’s no secret that many people struggle with stress and worry. Admittedly, I am a natural worrier. I tend to think of the worst-case scenario first and what would my plan be if that happened. I always want to have a plan, a backup plan, and perhaps a backup for the backup plan. A recent survey by Capital One and The Decision Lab found that 77% of Americans reported feeling anxious about their financial situation. That’s an alarming number of people who are unsure about their financial future!

When you step back and look at the landscape we’re in, though, I can see how people would be worried about their financial future.

At the time of writing this article, we are just a couple years removed from a worldwide pandemic that changed everyone’s daily lives, on the heels of the highest inflation we have seen in 30 years, had rising interest rates over the past couple of years, a bear market (20% + drop) in stocks, a war began in Ukraine, and now tension in the Middle East. It’s no wonder people don’t feel great about their financial picture. The start to this decade has been a whirlwind to say the least.

Amid all of this, I think looking at history will give us a good guide map for the road ahead.

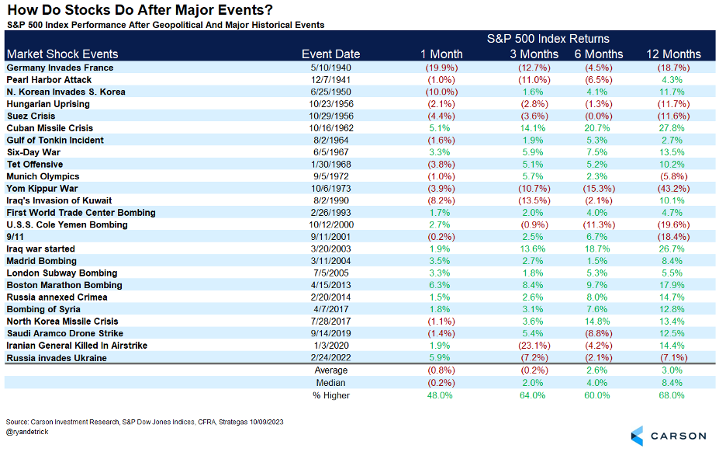

As they say, history may not repeat itself, but it tends to rhyme. Ryan Detrick, Chief Market Strategist of Carson Group created this chart that shows how the S&P 500 has performed after some major geopolitical events since World War II. What’s interesting is, generally, there is an initial drawback in the first month or so but twelve months down the road the median return after one of these events was a positive 8.4% return. In other words, if you initially reacted to these events and went to cash out of fear of what was to come over the next year you would have missed out on a median return of 8.4%.

Sure, there are times when leaving your money in the market would have come back to bite you, but ultimately, investing is a marathon not a sprint.

Warren Buffet’s secret to investing isn’t just that he’s a good investor (although he’s pretty good) – it’s time. His secret is he has been investing since he was 10 and he’s now 93. That’s 83 years of staying invested. In his words, “Be fearful when others are greedy, and be greedy when others are fearful.” If he had started investing when he was 30 and retired at 65, he’d probably still be wealthy but nothing close to his net worth today.

The chart that Ryan made only measures returns after geopolitical events in the world. There are many other events that cause fear and compel people to leave the market. Among them is inflation, interest rates, political issues, elections, recessions, and the list goes on and on.

If you only ever invested money when you felt confident in world and the markets, you’d more than likely never enter the market.

Certainly, there’s a risk to being too aggressive, but there’s also very real risk to being too conservative.

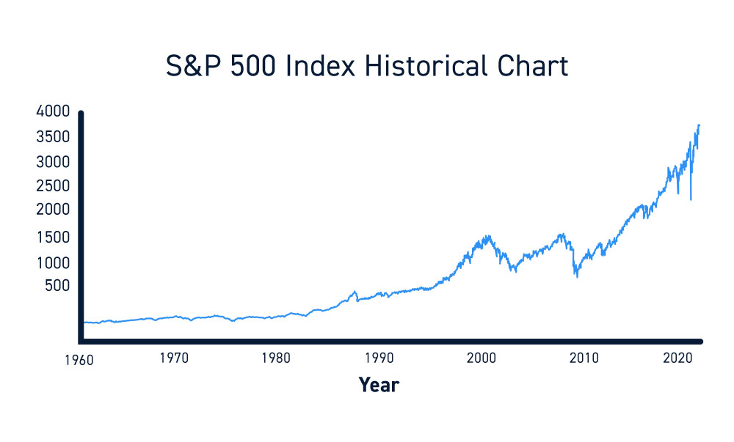

The chart below shows the S&P 500 since 1960. The trend is clear. It’s not always a straight line up but history goes to show the market rewards patience and resilience.

If you feel anxious about your financial situation currently or what it will look like in the future, we would love to help and make sure you’re on the right path forward. Having an advisor who can give context to situations and help show the bigger picture can be big difference in how people feel about their finances. Schedule a conversation.

S&P 500 – A capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.