By Jaymon Meikle, CFP®, Wealth Advisor

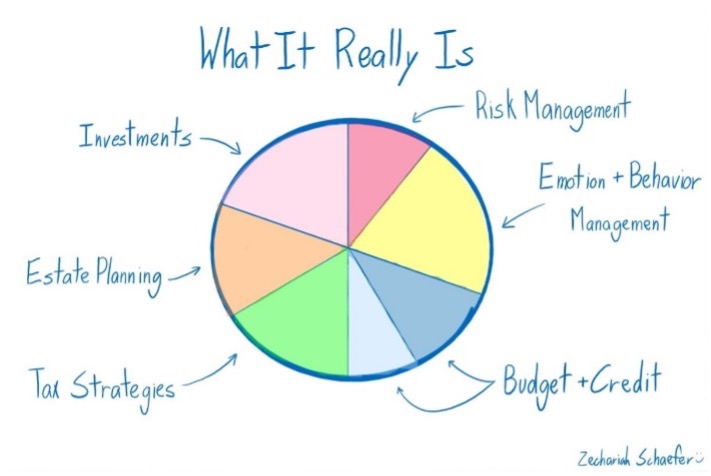

On every conference room table, we have the picture below.

These last few weeks have been difficult for many investors to endure. With the volatility and concerns over the potential government shut down, some people were wanting to sell everything, go to cash, and “wait out the storm.” It’s times like these that the yellow piece of the graph above, Emotion and Behavior Management, or coaching as some of us like to refer to it as, comes into play.

Seeking safety is natural.

First off, it is understandable to be concerned and to want to seek “safety”. Watching your hard-earned money go through the ups and downs that are a characteristic trait of the market can be difficult all on its own, even without the added concerns of any other outside factors. One of the ways we help with this is by making sure that we’re taking an appropriate amount of risk (part of the dark pink piece in the graph) in your portfolio so that you can weather the ups and downs when they come.

Even with an appropriate amount of risk, there’s still the possibility that the temptation to “wait out the storm” will still come. In these times, that’s when we as advisors must do what’s in your best interest, even when it’s difficult to do so.

Timing the market is flawed.

You may be asking “how is it in my best interest to not wait out the storm”? Well let’s talk through what waiting out the storm means practically. To “wait out the storm” means to try and time the market, which is the practice of trying to sell when the market is going to continue to go down and buy back in before the market recovers. The biggest flaw when it comes to market timing is that you have to be right (which, in this case, also means lucky) twice for it to be of benefit. If you sell either too early or too late or buy back in either too early or too late then it could actually do more damage than good.

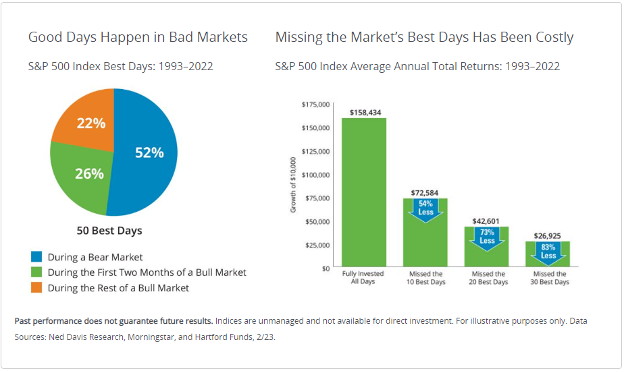

Let’s look at some hard facts that can help with this. Below is a graph from an article done by Hartford Funds that you can find here. In the article, it talks about what can happen if timing the markets didn’t go perfectly. For example, for an investor missed the 10 best days in the market over a 30-year period from 1993-2022, that investors return would have been cut in half. Let that sink in. There is about 252 trading days each year, which means over a 30-year period there was roughly 7,560 trading days. So, by missing only 10 days out of 7,520, or 0.13% of the days, the return was cut by a little more than half of someone who stayed in the whole time.

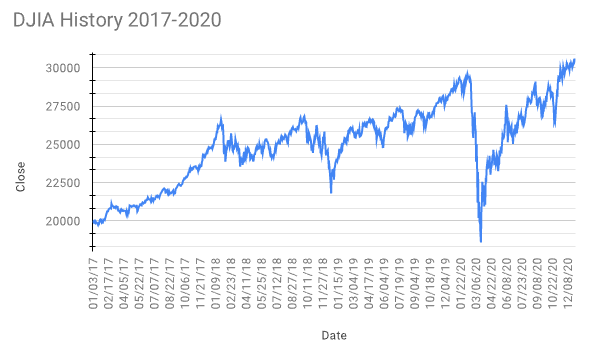

Let’s talk about one more example, which most of you experienced. The year 2020 was a very memorable year for all, and the market was just one of the reasons why it was so ingrained in our memories. The DJIA (Dow Jones Industrial Average) was one of the indexes that got hit hard with the lockdowns. On February 20, 2020 the DJIA closed at 29,219.98. More and more businesses were announcing lockdowns and soon it seemed like the whole country had locked down. Barely a month later, on March 23, 2020, the DJIA closed at its bottom that year at 18,591.93.

I remember talking with clients during March of 2020 and having to do my best to help them to remember their plan and help them look at the big picture when it comes to investing.

The Dow Jones Industrial Average bounced back – and then some.

On April 24, 2020, just 11 days after its low, the DJIA was back up to 23,775.27, an increase of over 20%. By November 10,2020, the DJIA closed at 29,420.92, making back the losses from the COVID crash, and continued to climb from there, and closed out the year up 7.25% in total.

Imagine trying to time the market in March of 2020. You watched the previous month end on a big slide down, the news is talking about all the doom and gloom, and everyone is scared. You hold off selling out just in case, and before you know it the market is down even further. You finally decide to sell, and initially it feels good because the market continues to go down for another week or so. Then suddenly there’s a bounce. Is this the start of the recovery? The news says it’s a temporary recovery, so you hold off and wait for the next big downward dip. A few weeks go by and the bounce is still going, so you buy back in, but at a higher price than what you sold at in the first place. Your account starts to recover but you’ve missed the momentum and gains that come at the start of any recovery.

This is a bit of an extreme example, but this was a recent time period of a lot of uncertainty, and many people were looking to “wait out the storm”. When these times come up again, please reach out to your trusted advisor so that they can help you through it. Don’t have a trusted advisor? Schedule a conversation!