By Scott Keegan, Chief Operating Officer/Associate Wealth Advisor

There’s no doubt that one of the most crucial pieces of a person’s financial plan is having an emergency fund. This is one aspect of a financial plan that everyone needs no matter what age, income, or any other variable changes. The emergency fund is the cornerstone and foundation of your financial plan.

Recently the furnace in our house went out. While this was no doubt a nuisance and caused us to stay at the in-laws for a cold winter night, it didn’t hurt us all that badly financially because we knew these types of events are exactly what the emergency fund is for. Luckily our neighbor was able to fix it for us and only charged us for new parts – you have to love good neighbors!

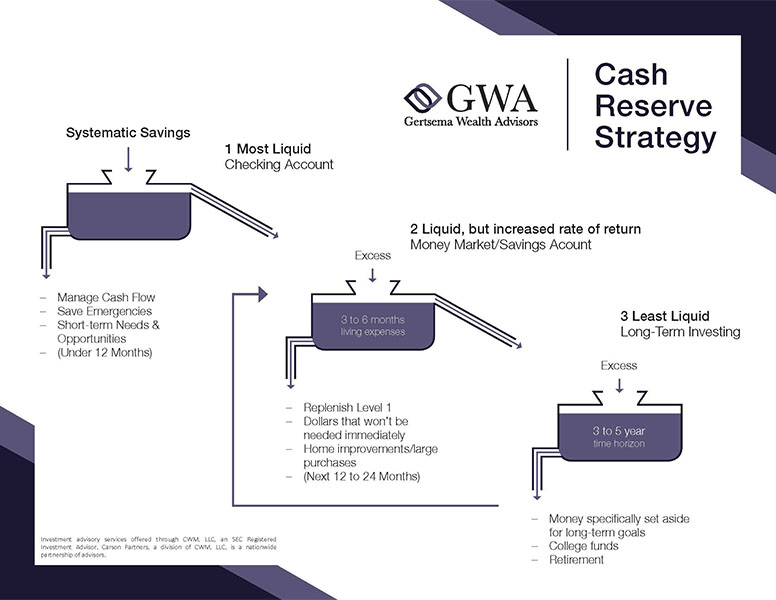

The Emergency fund as shown above is the 2nd bucket in terms of your cash reserves & investments.

- The 1st bucket is your checking account, that’s where income comes in and where you pay the bills out of. It should be enough to cover your short-term needs (think about 2-3 months of living expenses).

- The 2nd bucket is your “emergency fund” – your savings account. This is where you need to have at least 3-6 months’ worth of living expenses sitting in cash. For example, if your family spends $4,000 per month, you will need $12,000- $24,000 in savings to have an adequately funded emergency fund.

- The 3rd bucket is your long-term investments. This consists of retirement accounts, college funds, or savings for a large purchase down the road. This is money you have set aside for a specific goal in mind.

What’s a Mental Minimum?

So, while 3-6 months living expenses are the “technical” answer of how much to keep in an emergency fund, we often ask clients, “what’s your mental minimum?”. In other words, how much do you need in your savings account to sleep well at night?

Risk it for the biscuit.

Some people are comfortable keeping less than 3 months’ worth of living expenses in savings. To them, we strongly encourage them to build that mental minimum up and increase the amount of money in savings.

It doesn’t take long for them to think about the last time life happened to them (i.e., car broke down, furnace went out, etc.) and how stressful that time was not having cash on hand to get things fixed right away. Often, once they increase their savings, they get used to that higher amount in there and that becomes their new mental minimum and any less in savings makes them nervous.

Sometimes, especially with younger clients, they are excited to invest and let their money work for them. They want to skip the emergency fund or not fully fund it. The problem is when they invest money in the long-term bucket with a retirement account, it is tied up until a certain age (generally 59 ½) to withdraw penalty-free. If the money is in a brokerage account and they can access it penalty-free, an emergency may come up when the market is at a low and they must sell at the lows because they need money now and don’t have other cash available.

But I’m a Nervous Nelly.

Others like to keep what’s possibly too much in their savings and try to be prepared with cash for anything life may throw at them. I definitely fall into this category. Their mental minimum is much higher than 6 months living expenses.

While this could seem like a good thing, there are some issues that can arise. You may be keeping money you really don’t need on the sideline and not growing or earning interest like it could if it were invested properly.

Another issue having too much cash raises is this: yes, it may not be very volatile or fluctuating regularly with the market, but if inflation is high like it has been the past couple of years that cash is losing purchasing power.

Inflation, measured by CPI, was 5% year over year in March 2023, meaning if you had $10,000 cash a year ago its purchasing power today is the only equivalent of $9,500. You, in essence, lost $500 just from inflation alone without taking on any market risk.

There are different options of how to invest this extra money in saving in a conservative way where it is still liquid if needed but can earn some interest and/or value appreciation. This could involve a high-yield savings account, CD’s, brokerage account, etc.

Find your Mental Minimum

It’s worth everyone’s time to think about which side they tend to fall on when it comes to an emergency fund, such as keeping less or more in the account than needed, and what the pros or cons to the amount you keep on hand are. Also, dialing in on what my mental minimum is and is it the correct amount for me and the stage of the game I’m in? This is just a piece of your financial plan, but it is a crucial piece to nail down.

If you need help developing your plan or figuring out if your mental minimum correct, please reach out to us to schedule an appointment. It’s too important to put off because life has a way of creeping up on us when we least expect it.

This piece is not intended to provide specific legal, tax, or other professional advice. For a comprehensive review of your personal situation, always consult with a tax or legal advisor.